Cuvva spreads its wings to fly into profitability

Like a butterfly crawling out of its chrysalis, Cuvva has made a profit for the first time in its nine-year existence.

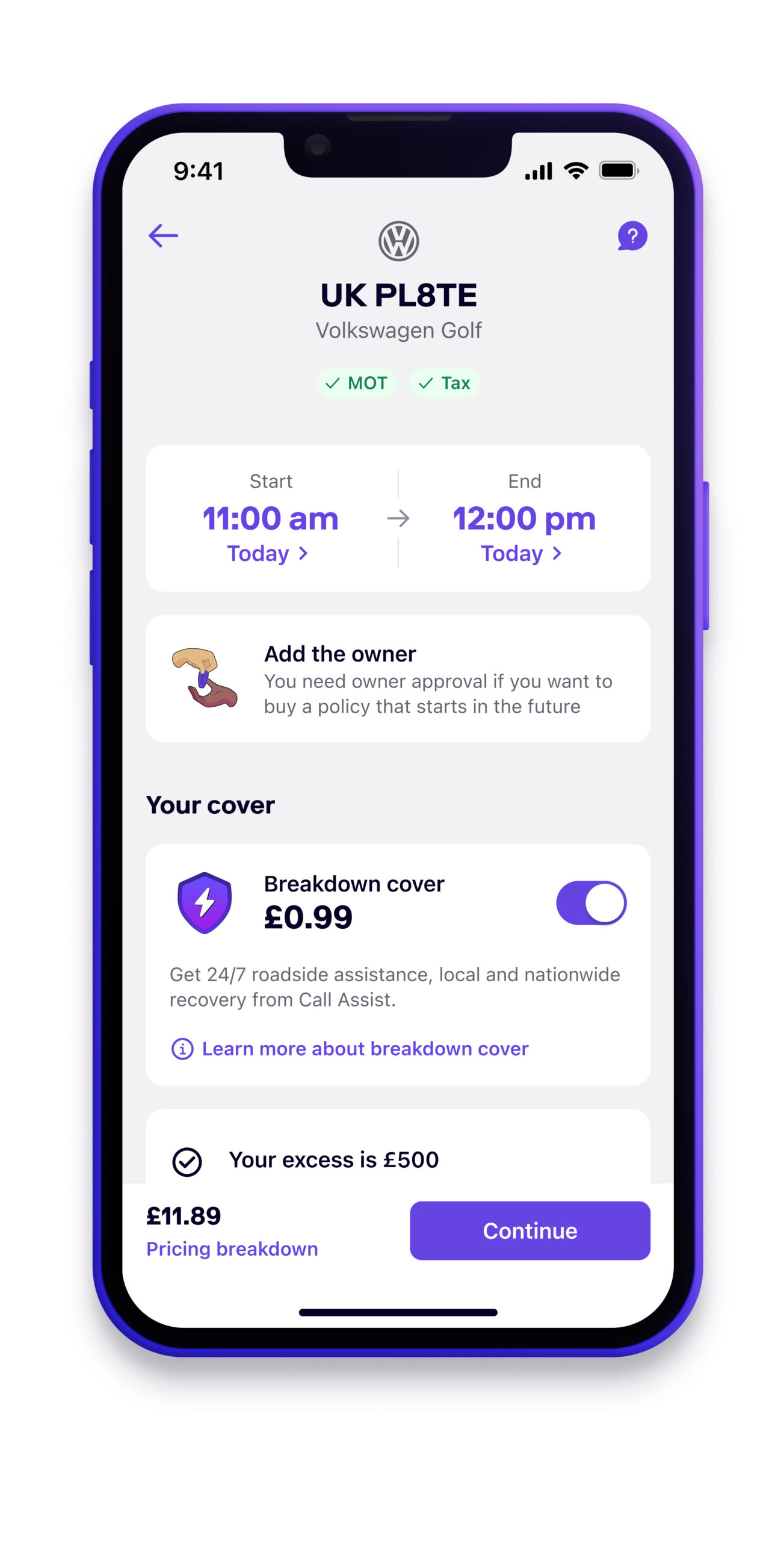

The innovative short-term car insurance broker has spent about £100 million on the journey from an idea dreamt up by Freddy Macnamara and James Billingham, its founders, to a leading brand in its niche, used by 1.5 million people when they borrow someone else’s car. Apparently, a quarter of all 25-year-olds in Britain have downloaded its app.

Profitability — the business equivalent of becoming a butterfly — became the goal for many venture capital-backed technology companies after such funding slowed in 2022. Many will not make it, but Cuvva shows what is possible. According to accounts filed last month show, in 2023 it recorded revenue of £21.2 million and a profit of £3.8 million, adjusted for depreciation and share-based payments and compared with a loss of £6 million in 2022.

“It’s taken nine years to get to the point where it is fun,” Macnamara, 36, said. He noted that in the weird and wonderful world of running businesses that lose money, the first thing to understand is that Cuvva’s main product — insurance to borrow a friend’s car, typically for an hour — has been profitable since 2016.

The cost of creating consumer demand and the systems to serve it, including marketing and product development, pushed it into the red each year. In its specific market, Cuvva also has had to contend with soaring reinsurance prices and rocketing vehicle repair bills since Covid.

Macnamara estimates that it has taken £100 million of spending to make Cuvva the business it is today. To cover the cost, it reinvested its own cash and tapped external investors for nearly £25 million, notably from RTP Global and Breega, which led its largest round of fundraising in 2019, when Bruce Carnegie-Brown, chairman of the Lloyd’s of London insurance market, joined Cuvva as its chairman. In a subsequent £4 million crowdfunding round in 2022 , 3,059 private investors opened their wallets in only 24 hours.

Macnamara has diluted his own holding to bring in the new investors, but has managed to retain a 27 per cent stake. Billingham, 29, who stepped out after five years, remains a shareholder and all Cuvva’s employees, past and present, who do more than one year of service can be shareholders. Collectively they own between 15 per cent and 20 per cent of the business.

Cuvva’s story of success started in 2022 with clarity that the fundraising environment had changed. The company’s target for 2023 was no longer to double its gross written premiums, the value of the policies sold, but instead to make a profit. “When you put that at the top of the business and everyone understands it, it means they know they can’t ask for that extra hire, that extra piece of software unless they have an extremely good set of reasoning behind it.” The company hit its target within two months of its 2023 financial year.

It was quite a change for Macnamara. He was used to seeing more money flowing out of the business than coming in as the directors pursued revenue growth with the blessing of their investors. “It was not a case of me wildly going around spending it. It was how can I use this to generate a return that is outsized over a shorter period of time and build a substantial business off the back of it.”

Today things are different. Would he ever raise venture capital again? “I hope not. It’s tremendously empowering seeing the bank balance go up every single month, rather than down.”

In truth, Cuvva had set itself up to succeed. The path to profitability involved more than simply cutting overheads. For many years it has automated its systems so that it costs virtually nothing to bring new customers on board once it has them in its net. This approach was partly down to necessity. Macnamara had only limited funds to start Cuvva, so instead of buying off-the-shelf policy administration systems, it built its own. While painful to start with, it has meant the company does not have to pay fees to third parties for taking on customers, enabling Cuvva to offer insurance for an hour, day or month, rather than the usual annual policies.

It also allows it to operate efficiently at scale. Cuvva writes half the number of policies that Admiral does, but with 100 staff compared with the insurance powerhouse’s 12,000. “We really have built the insurance distribution platform of the future.”

It also has used the consumer technology available to its customers to help it to assess the risks they pose and in recent years has deployed AI to automate tasks that once were manual. Customers take pictures of the vehicle they want to insure. Macnamara says that sometimes they show pre-existing damage that hasn’t been declared and even the odd police officer in the background (“It happens a lot”), which helps Cuvva to manage its exposure to fraud.

“[Before AI] we had a customer operations team looking at all these pictures; AI now allows us to look at them all automatically and detect damage, whether it is the correct vehicle, whether it is day or night.” It is now also applying AI to “triage customer queries. Our customer satisfaction score has gone from 85 [at the end of 2023], which is industry-leading, to 92 with the roll out of the [chat]bot. We didn’t know it was possible to get there. And it means we can give humans the time to work on trickier tasks.”

Macnamara published a chart in the company’s accounts that depicts the turnaround in the profitability from the first three months of 2022 to the last three in 2023. “[It shows] the tipping point. Once we hit our fixed costs, the marginal cost of selling a policy is virtually zero, so most of the additional revenue falls straight to the bottom line. It turns around very quickly at that point and that is what everyone is aiming for.”

Despite its successes, Cuvva hasn’t had an entirely smooth ride. A move into travel insurance proved short-lived when the Covid pandemic hit. Last year it had to withdraw a product called “Subscription” that allowed people to insure their own car because it wasn’t making its underwriting partners any money. “Rolling people off that product knocked our [customer satisfaction] score, unfortunately.” It was only a temporary blip.

Macnamara is now gearing himself up for Cuvva’s next ten years. He has his eye on the fledgling car share market as he thinks there are enough things now in its favour — expensive entry-level electric vehicles; no gearboxes to wear out; easy tracking; and the public’s growing interest in sustainability — to make it take off.

Two weeks ago Cuvva launched a “car clubs” product and already it has had 4,000 clubs sign up. “We have built free software tools that allow you to run a car club for your friends, family members or your local community. I [told the team developing it] that I want it to have absolutely no headaches when I lend my car to people and I want to take absolutely no risk.”

Selling services into new, unproven markets can be expensive. Cuvva would be even more profitable if it didn’t. But now that Macnamara doesn’t have to worry about the bank balance as much, he seems happier to stray from the shore. “I think it is a very worthy goal for the company to make cars multiplayer.”

Post Comment